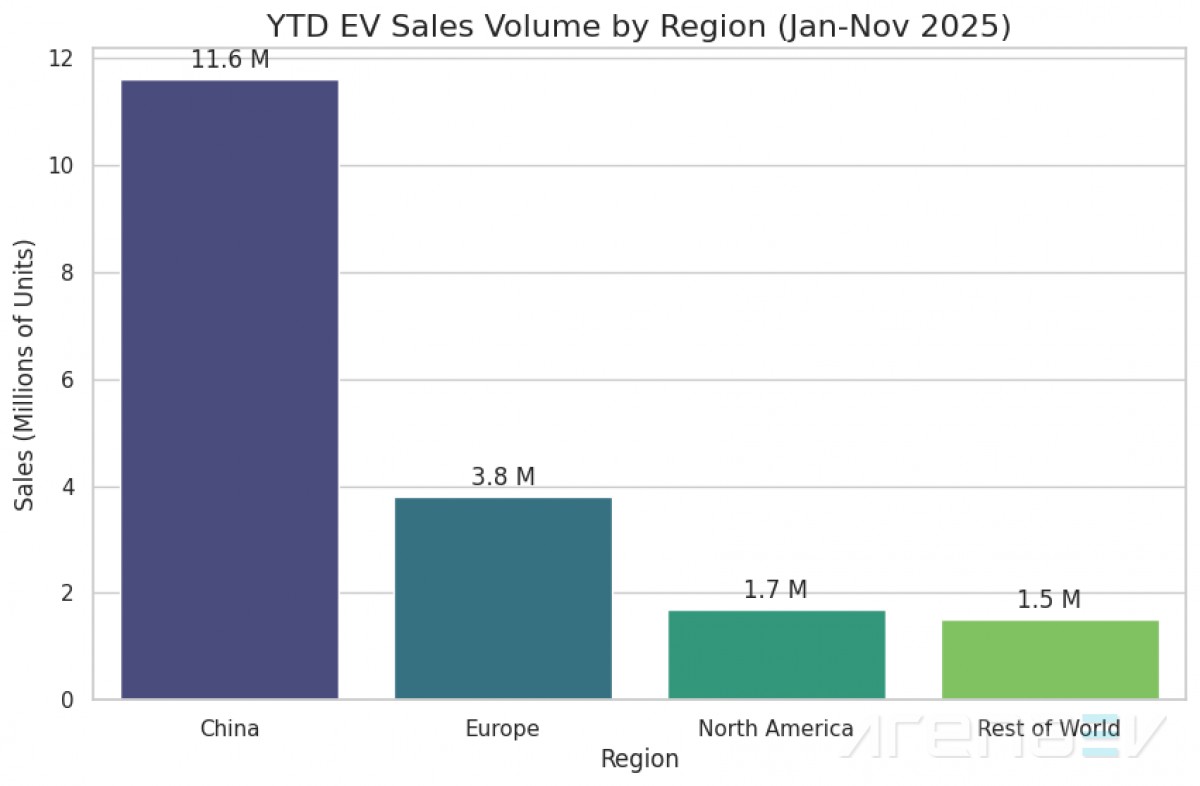

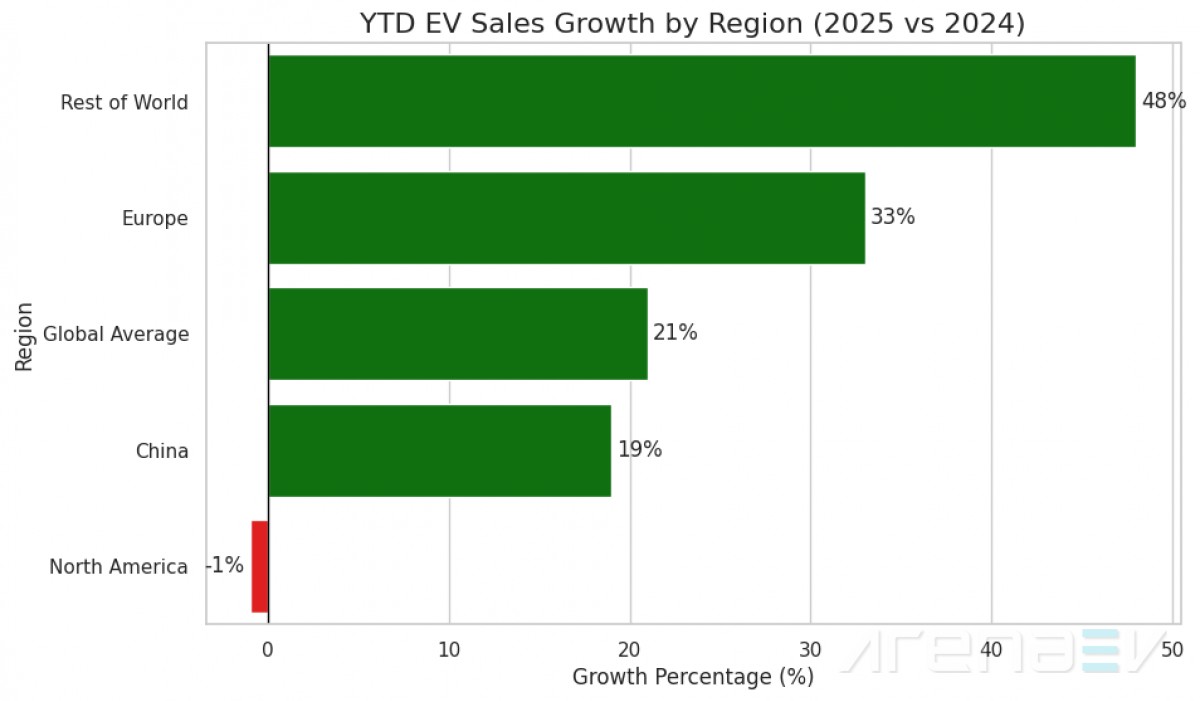

Benchmark Mineral Intelligence and Rho Motion report that global electric car sales reached a record 18.5 million units by November 2025, marking a 21% increase compared to the same period last year. November alone accounted for 2 million electric vehicles sold worldwide, highlighting strong demand fueled by supportive government policies and an expanding variety of models.

Europe leads this surge with a 36% year-over-year increase in November, bringing the region’s year-to-date total to 3.8 million electric cars—a 33% growth overall. This acceleration is largely due to renewed government incentives. In France, after a sluggish start caused by earlier subsidy cuts, sales rebounded with a 1% rise by November, aided by major manufacturers like VW Group and Renault, and a social leasing program assisting low-income families in adopting electric vehicles.

Italy also experienced record sales in November, moving nearly 25,000 electric cars following the introduction of a new incentive scheme aimed at replacing older internal combustion engine vehicles. The program allocated $699.74 million to retire approximately 39,000 outdated cars. In the United Kingdom, five additional models—including the Nissan Leaf, MINI Countryman, Renault 4, Renault 5, and Alpine A290—became eligible for the full $5,150 subsidy, further stimulating sales.

China remains the largest market, with 11.6 million electric vehicles sold in 2025—a 19% increase over 2024. However, growth is moderating, with November sales rising just 3% year-over-year. Despite this, Chinese automakers continue expanding their global presence. BYD set a new company record by exporting 131,935 units, surpassing its previous high of approximately 90,000 in June. BYD’s European sales quadrupled to around 200,000 units in 2025, while sales doubled in Southeast Asia and grew by over 50% in South America.

In contrast, North America’s electric vehicle market slowed, with 1.7 million units sold year-to-date—a 1% decline compared to 2024. The decrease followed the expiration of the U.S. federal tax credit on September 30, 2025, which led to a sharp drop in October sales. While November showed month-over-month gains, including 30% growth for Kia and 20% for Hyundai, overall sales remain significantly lower without the tax incentive.

Compounding challenges in the U.S. is a recent policy change resetting the Corporate Average Fuel Economy (CAFE) standards. The new regulation requires automakers to achieve an average fuel economy of approximately 34.5 miles per gallon by 2031, a substantial rollback from the previous target of around 50.4 miles per gallon. This relaxed requirement reduces the incentive to prioritize electric and plug-in hybrid vehicles, as manufacturers can meet standards through improvements to gasoline-powered cars alone.

Industry analysts warn that this policy shift may slow electrification in the U.S., a concern underscored by Stellantis’ $13 billion investment to increase internal combustion engine production by 50% domestically.

The 2025 sales figures illustrate a resilient global electric vehicle market strongly supported by policy and product availability. While Europe and other regions experience robust growth, North America is slowing due to reduced incentives and relaxed regulations. Continuous government support remains crucial to sustaining momentum in the transition to electric mobility.

Source