China, the world’s largest and fastest-growing electric vehicle (EV) market, continues to showcase a clear trend: local automakers are pulling ahead, while international competitors struggle for smaller market shares. Recent data from the China Passenger Car Association (CPCA) highlights BYD's dominant position and Tesla’s continuing challenges as the year wraps up.

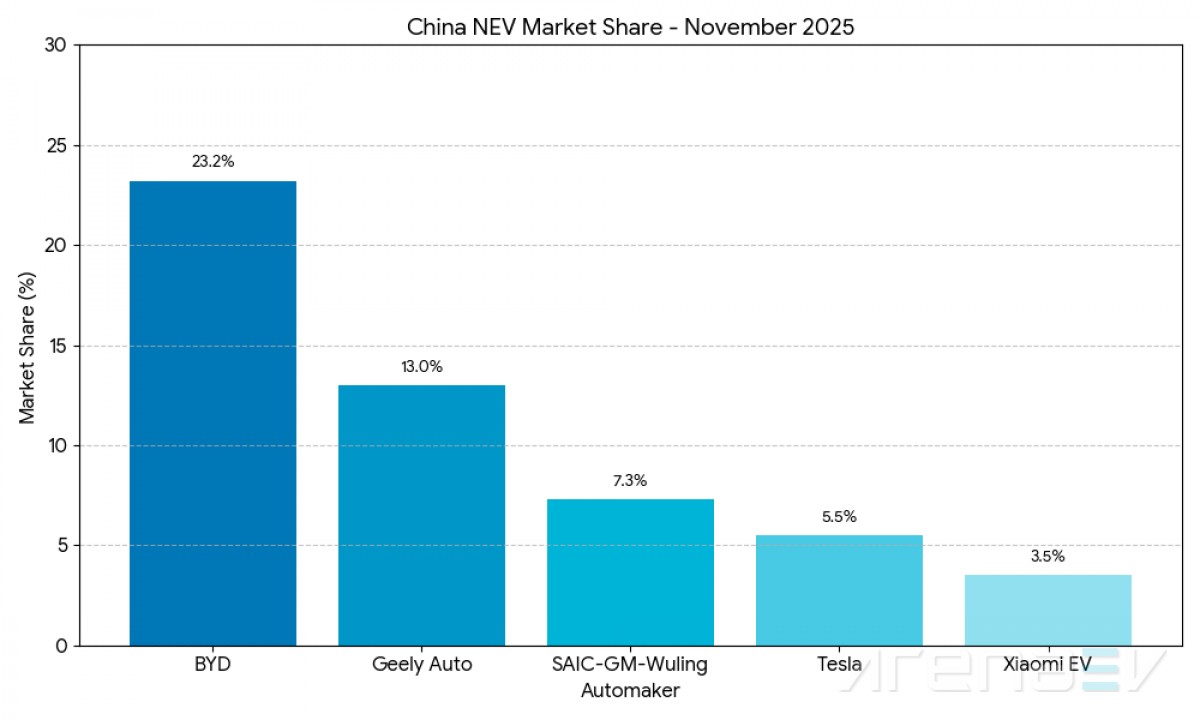

BYD, offering both pure electric and plug-in hybrid models, led November sales with 306,561 new energy vehicles sold at retail. This represents a 23.2% market share, slightly up from 23.1% in October, signaling the company’s steady hold on the top spot.

Following BYD, Geely Auto secured second place with 172,169 new energy vehicle sales. Geely’s figures grew 4.8% month-over-month and soared 42.4% compared to November last year, demonstrating robust momentum.

Tesla rebounded strongly in November after a difficult October, delivering 73,145 vehicles in China. This marks a dramatic 181.3% increase from October’s 26,006 units and earned Tesla fifth place with a 5.5% market share. However, despite this monthly recovery, Tesla's November sales remain 5% below the same month last year.

The competition in China is intensifying, with a range of strong alternatives emerging. SAIC-GM-Wuling captured third place in November by selling 96,194 units, achieving a 7.3% market share. Other newcomers pushed into the top 10, such as those propelled by models like the SU7 sedan and YU7 SUV, which sold 46,249 vehicles and held a 3.5% share.

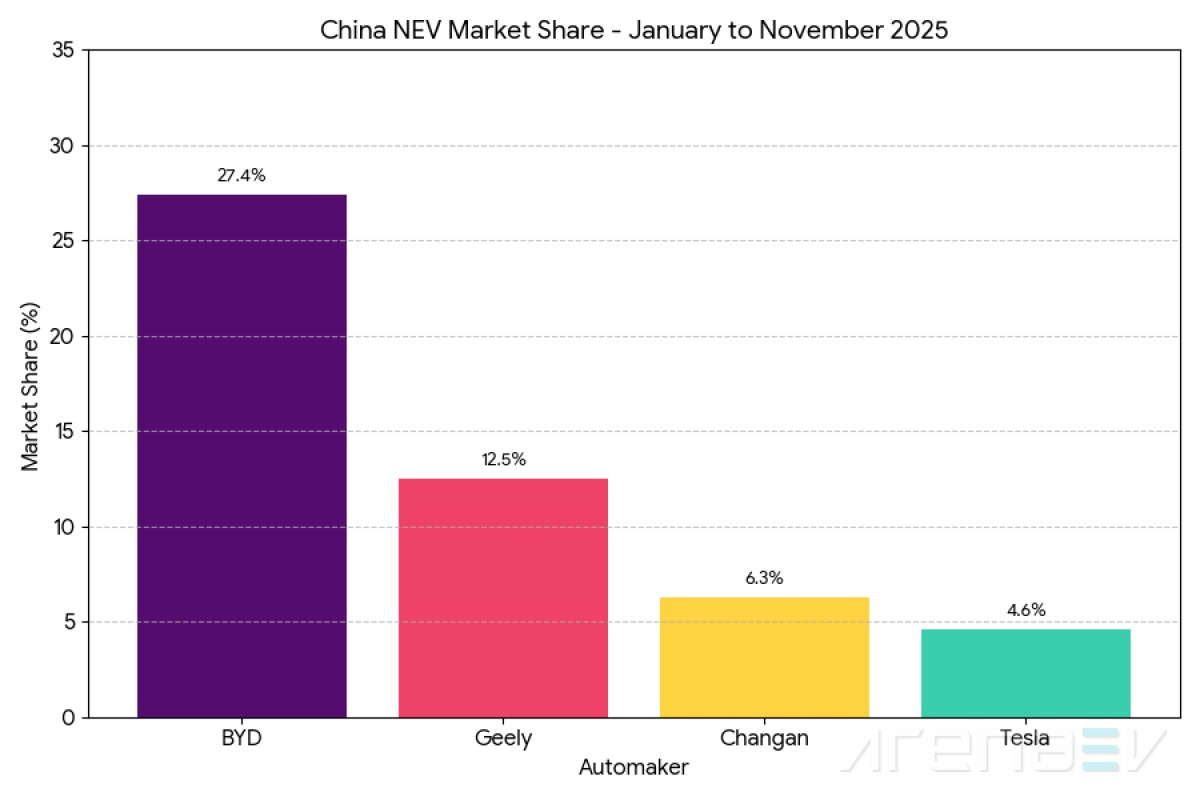

Year-to-date figures further underline the local manufacturers’ dominance. From January through November, BYD sold 3,144,671 new energy vehicles, securing a commanding 27.4% market share. Geely Auto is second with 1,428,573 sales and a 12.5% share, while Changan takes third with 727,511 units and 6.3%. Tesla ranks fifth with 531,855 sales, accounting for 4.6% of the market.

Tesla’s true challenge lies in reaching its 2024 annual total of 657,105 units, set last year. To match that figure, Tesla would need to deliver 125,250 vehicles in December alone. For context, the company’s best-ever retail month in China was December 2024, with 82,927 units delivered – well below the required target.

Even if Tesla manages a record-breaking December with 85,000 deliveries, its annual sales would still decline by 6%. This projected drop suggests demand for the Model 3 and Model Y is saturating, while rivals like Xiaomi and XPeng continue to report triple-digit growth. The increasing competition and slowing demand indicate that Tesla’s current incentives are unlikely to reverse this trend.