A recent report from China highlights the dominant role of local battery manufacturers in the global electric vehicle (EV) industry. In the first ten months of 2025, global battery energy storage surged to a record 933.5 GWh.

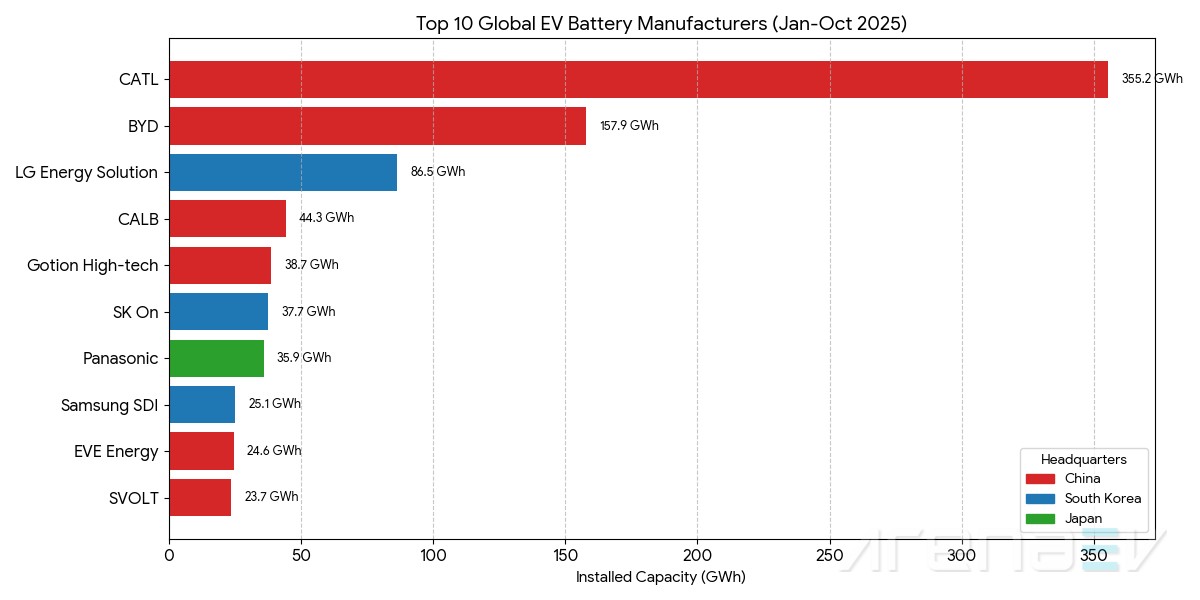

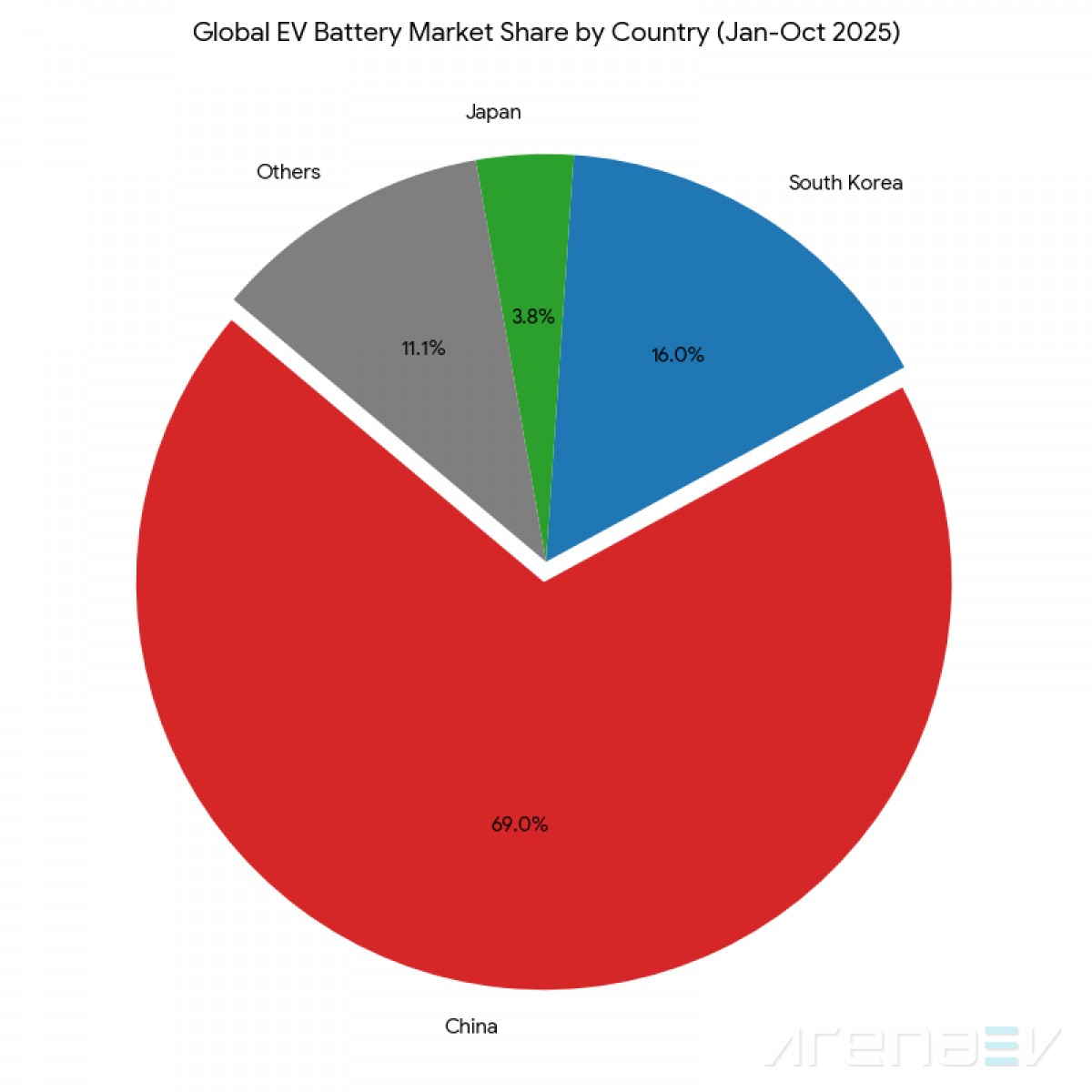

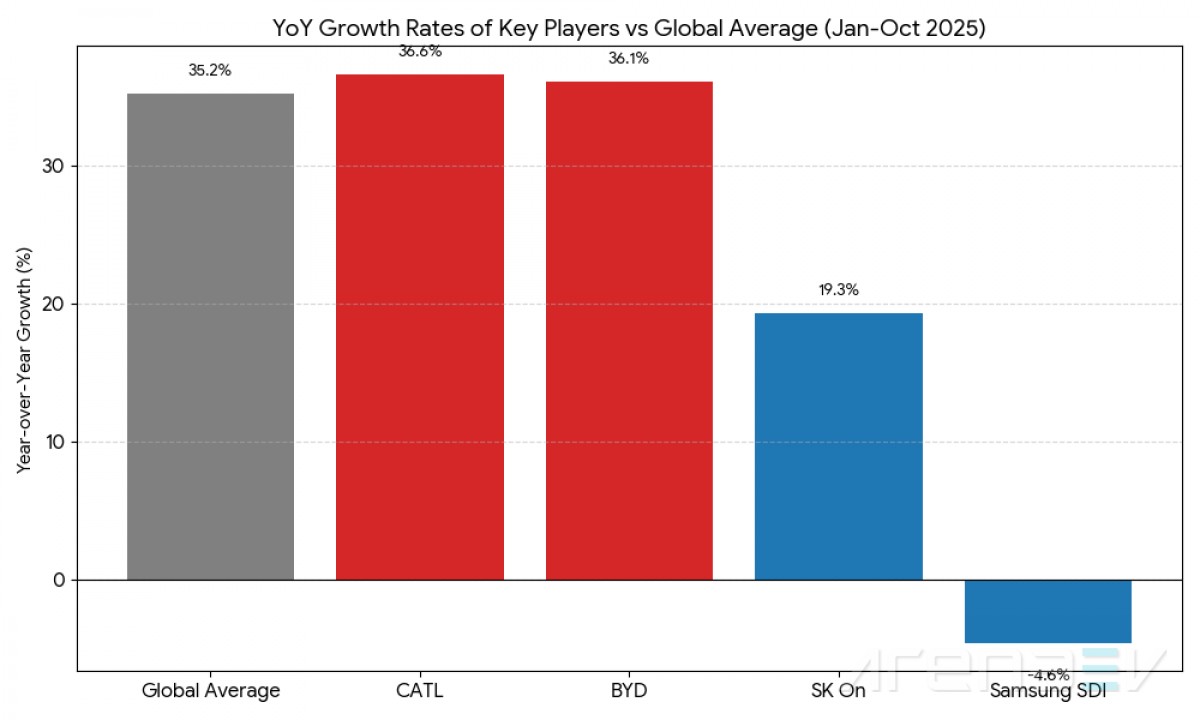

Examining the data reveals the primary sources of this growth. Six of the world’s top ten battery suppliers are Chinese companies, collectively controlling 68.9% of the global market with an installed capacity of 644.4 GWh—an increase of nearly 3 percentage points from the previous year. Leading this surge are Chinese powerhouses CATL and BYD, which together comprise over half of the world’s total installed battery capacity.

CATL remains the unrivaled market leader with 355.2 GWh installed, securing a 38.1% share—more than double that of its closest competitor. BYD holds the second position with 157.9 GWh installed and a 16.9% share. BYD’s uniqueness lies in its integrated approach, producing both batteries and electric vehicles, including plug-in hybrids. In November alone, BYD sold over 130,000 passenger vehicles and pickups overseas, nearly quadrupling last year’s numbers.

Other rising Chinese firms include Gotion High-tech (38.7 GWh, 4.1% share), CALB (44.3 GWh, 4.7%), E Energy (24.6 GWh, 2.6%), and SVOLT (23.7 GWh, 2.5%), which are steadily climbing the ranks.

Outside China, the remaining top suppliers hail from South Korea and Japan, though their combined market share has dipped slightly. LG Energy Solution ranks third with 86.5 GWh installed capacity and supplies batteries to key automakers like Kia for models such as the Equinox, Blazer, and Silverado. However, slower sales of some Tesla models, which also utilize LG batteries, have tempered its growth.

Panasonic, a major Tesla supplier with 35.9 GWh installed, is actively pursuing new partnerships with other North American automakers. SK On (37.7 GWh) powers vehicles like the Hyundai Ioniq 5, as well as various Ford and Volkswagen electric models. Samsung SDI (25.1 GWh) supplies batteries for BMW’s i4, i5, i7, and iX models, along with the Audi Q6 e-Tron.

The competition for battery dominance spans multiple fronts. CATL’s batteries are used in numerous popular models from Chinese brands such as Zeekr and Xiaomi, as well as global manufacturers including Tesla, BMW, and Volkswagen. BYD is experiencing significant growth in Europe, where its battery usage rose by over 216% in the first ten months, fueled by its competitive and affordable EV offerings.

Looking ahead, the industry is shifting focus from pure global expansion to strategic localization. Companies are negotiating long-term agreements to secure raw materials and planning to increase battery production closer to major EV assembly hubs in North America and Europe. This approach demands agility in navigating diverse regional regulations and market demands.

As automakers continue to seek improved battery technologies—such as higher energy density and longer lifespan—and more resilient local supply chains, competition will intensify. Adapting to evolving policies and consumer preferences across markets will be crucial for industry leaders beyond 2026. The transition from gasoline to electric vehicles represents a fundamental shift in power, currently driven strongest by Asian manufacturers.