Samsung is currently facing an unusual internal conflict between its two major divisions—its semiconductor unit, Samsung DS, and its Mobile Experience (MX) business. The DS division has surprisingly declined a long-term order from MX for DRAM (Dynamic Random Access Memory) chips, a critical component for Galaxy smartphones. This refusal could result in rising costs for the upcoming Galaxy S26 lineup.

The Role of DRAM Chips in Smartphones

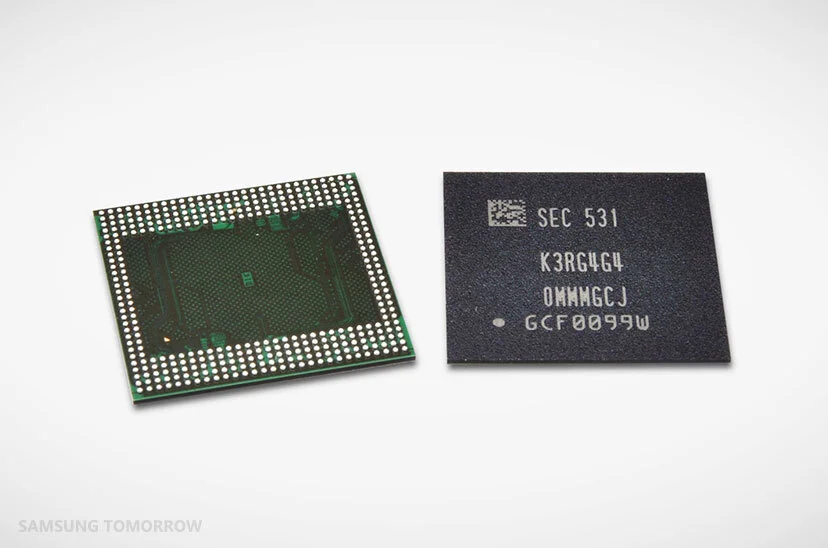

DRAM, particularly LPDDR (Low-Power Double Data Rate) memory, plays a vital role in improving smartphone multitasking, speed, and battery efficiency. When you launch an application on your phone, its core program and active data are quickly transferred from the slower UFS (Universal Flash Storage) to the faster LPDDR DRAM. This enables the CPU to handle operations efficiently, allowing apps to open swiftly without lag.

Supply Disputes and Rising DRAM Prices

Amid rising memory chip prices— with 12GB DRAM modules now costing roughly $70, more than double from earlier this year—Samsung MX requested a supply contract covering over a year’s worth of DRAM chips from the DS unit. However, the semiconductor division chose to reject this contract, opting instead to capitalize on the current high prices by selling to external phone manufacturers.

Impact on Samsung’s Mobile Division and Potential Price Hikes

Due to this refusal, Samsung MX must now negotiate DRAM supply every quarter rather than securing long-term stability. This fragmented procurement process, combined with continuing DRAM price increases, may push Samsung to raise prices for the Galaxy S26 series. The tension between the two units became so severe that Samsung’s top executives had to intervene and mediate the situation.

Quarterly Supply and Division Rights

Currently, the MX unit has only secured DRAM supplies for the fourth quarter (October to December). Under company policy, the DS division retains the right to refuse year-long supply contracts, giving it leverage in these negotiations.

Samsung's Broader Semiconductor Strategy for 2024

Looking ahead, Samsung aims to benefit from its chip manufacturing business in 2024, taking advantage of higher DRAM and NAND flash prices. Additionally, Samsung Foundry plans to ship advanced 2nm Gate-All-Around (GAA) chips, including the home-developed Exynos 2600 processor, slated to power Galaxy S26 and Galaxy S26+ models in Europe and South Korea.