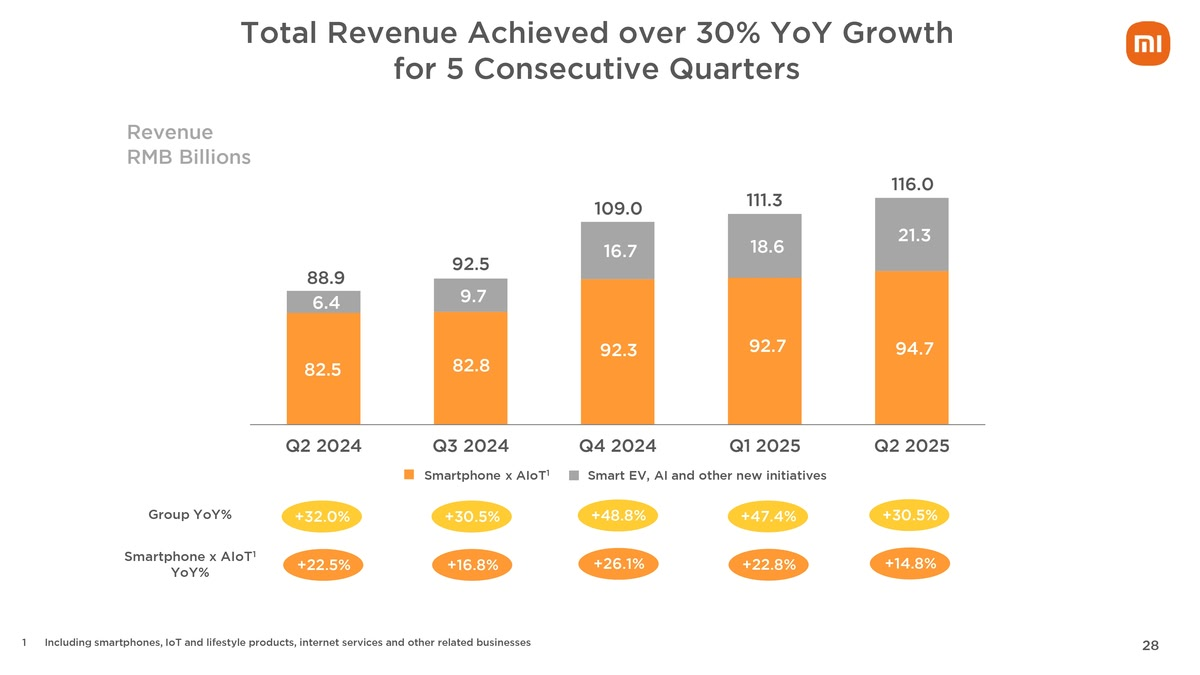

Xiaomi has reported a remarkable performance in the second quarter of this year, with total revenue reaching a record high of CNY 116 billion. This represents a 30.5% increase compared to the same period last year. The smartphone business continues to be Xiaomi's key segment, followed by IoT and Lifestyle products. Additionally, the company's Smart EV, AI, and Other New Initiatives segment is showing rapid growth.

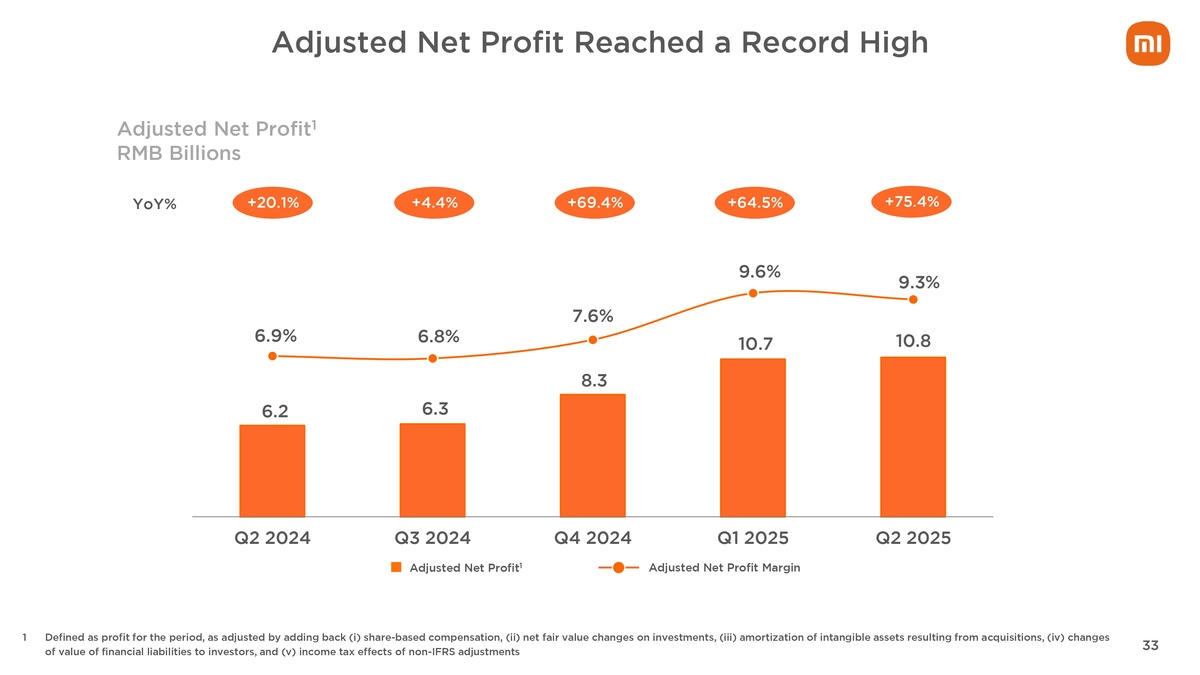

This marks the fifth consecutive quarter of year-over-year (YoY) growth exceeding 30%, with Xiaomi also achieving revenues of over CNY 100 billion for the third consecutive quarter. Adjusted net profit for the quarter was CNY 10.8 billion, reflecting a 75.4% YoY increase.

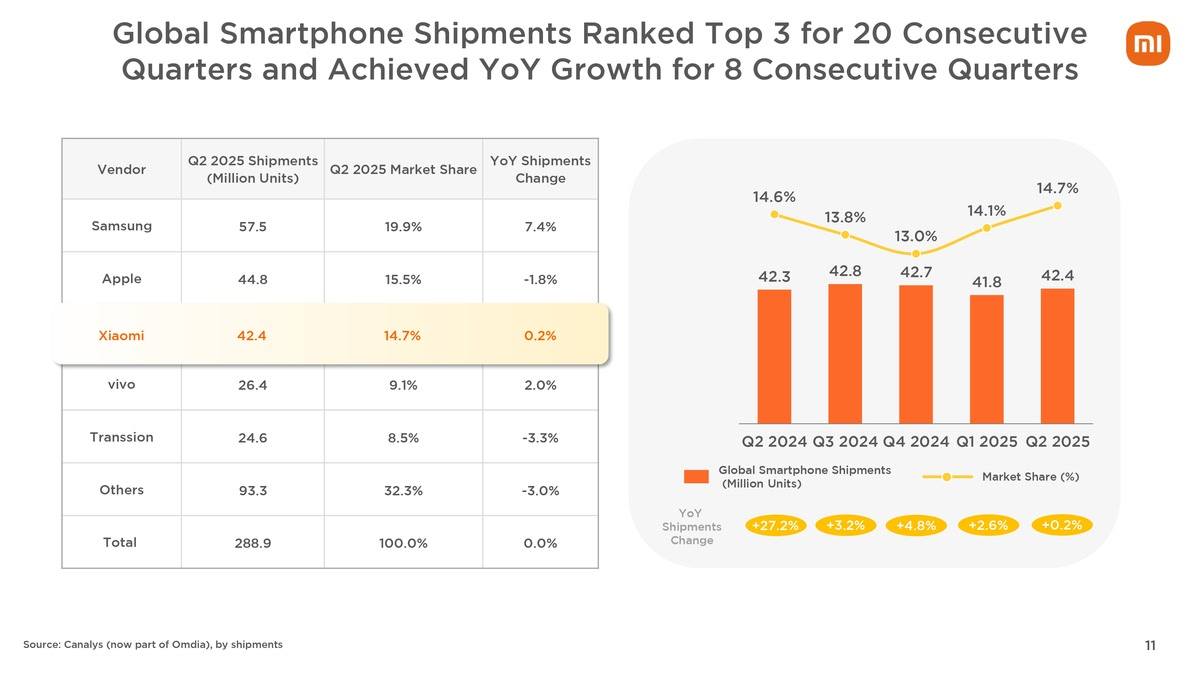

In terms of smartphone shipments, Xiaomi ranks as the third-largest company globally, having shipped 42.4 million units in Q2, which is a marginal 0.2% increase YoY. The company's performance is close to that of Apple, which shipped 44.8 million units in the same quarter.

Regionally, Xiaomi leads in Southeast Asia, ranks second in Europe, the Middle East, and Latin America, and holds the third position in Africa. In Mainland China, the company ranks fourth in terms of shipments based on data from Canalys.

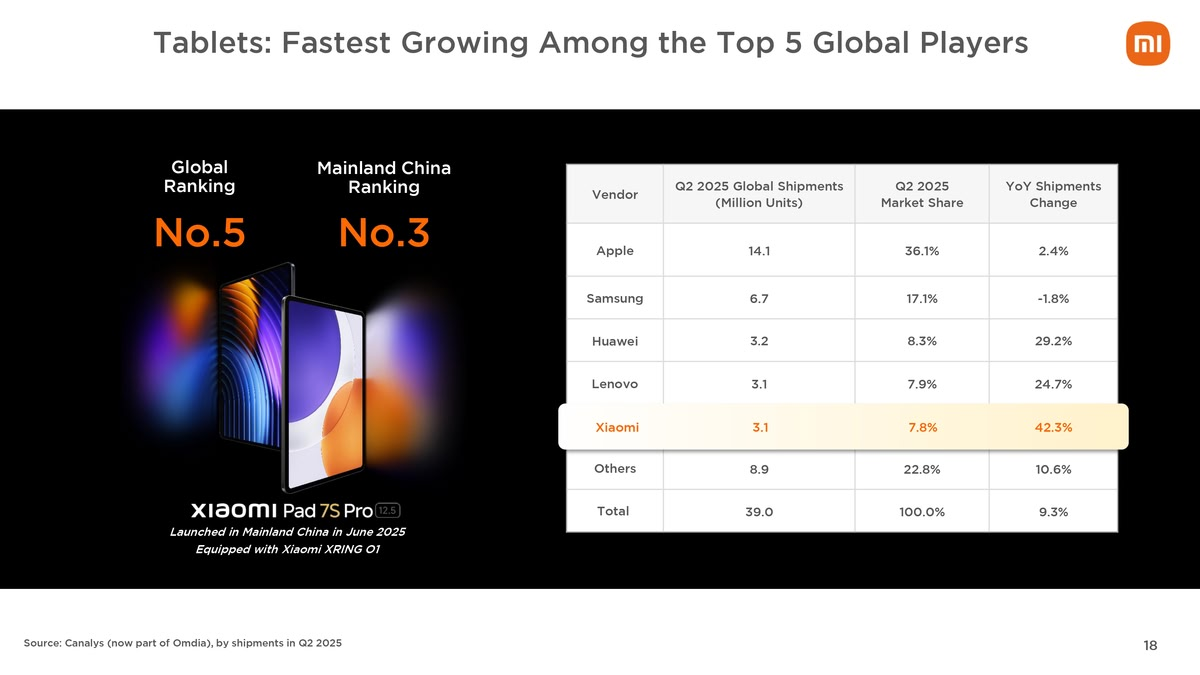

Although Xiaomi's smartphone revenue for Q2 2025 declined by 2.1% YoY, the company witnessed growth in sales of premium phones in Mainland China. Xiaomi's tablet sales also saw positive momentum, with global shipments increasing by 42.3% YoY.

Furthermore, Xiaomi's wearables segment, including smart bands and TWS buds, has performed well globally and in Mainland China. The company's expansion into new product segments, such as the Xiaomi Smart Glasses, illustrates its innovative approach.

Additionally, Xiaomi's venture into the electric vehicle market has been successful, with quarterly deliveries reaching 81,302 units in Q2. The company has also expanded its retail network, with a growing presence in Mainland China and abroad.

Overall, Xiaomi's diverse product portfolio and strategic expansions have contributed to its strong financial performance in Q2.