During the first half of this year, the Indian smartphone market experienced a 1% growth compared to the first half of 2024. According to IDC, 70 million units were sold in total, with 37 million smartphones shipped in the second quarter (April to June) alone, representing a 7.3% year-on-year increase.

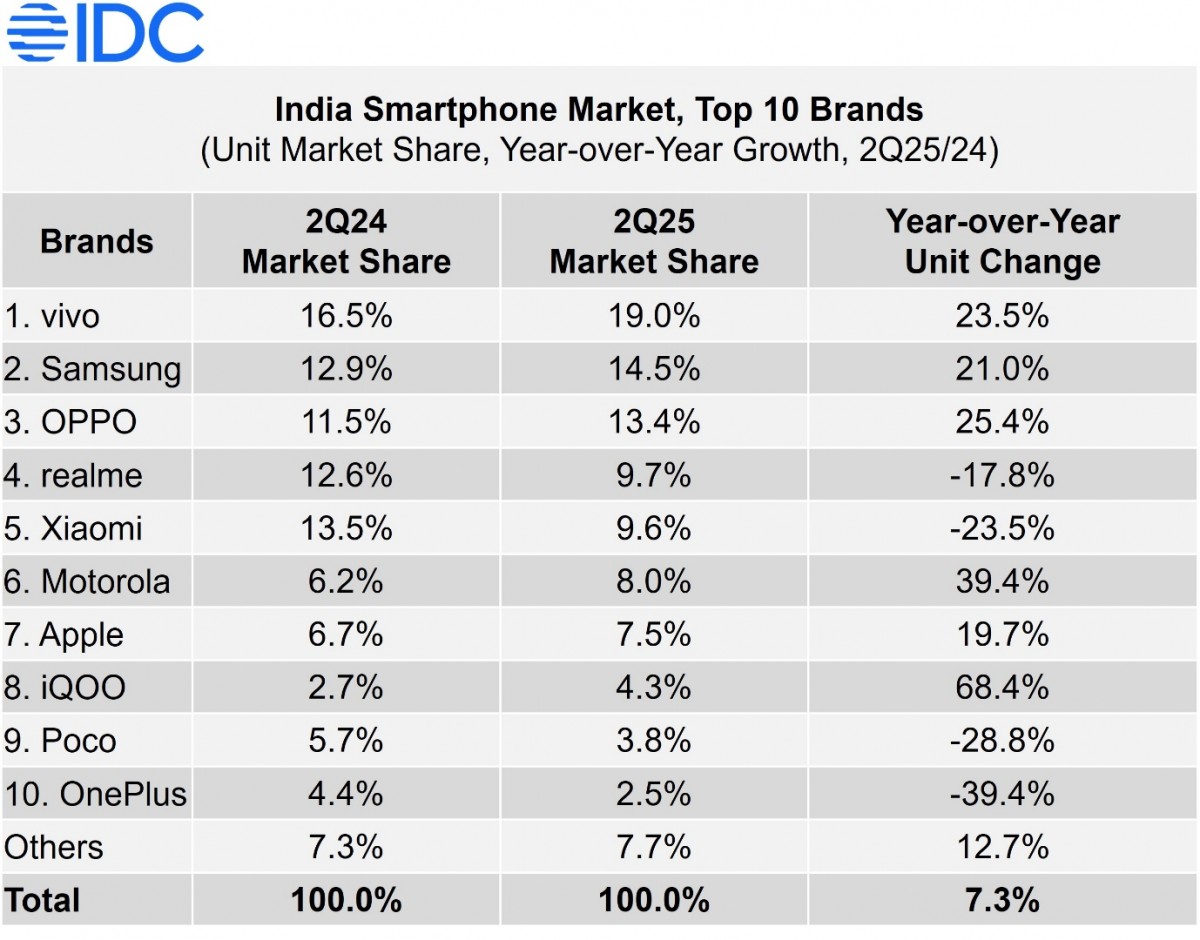

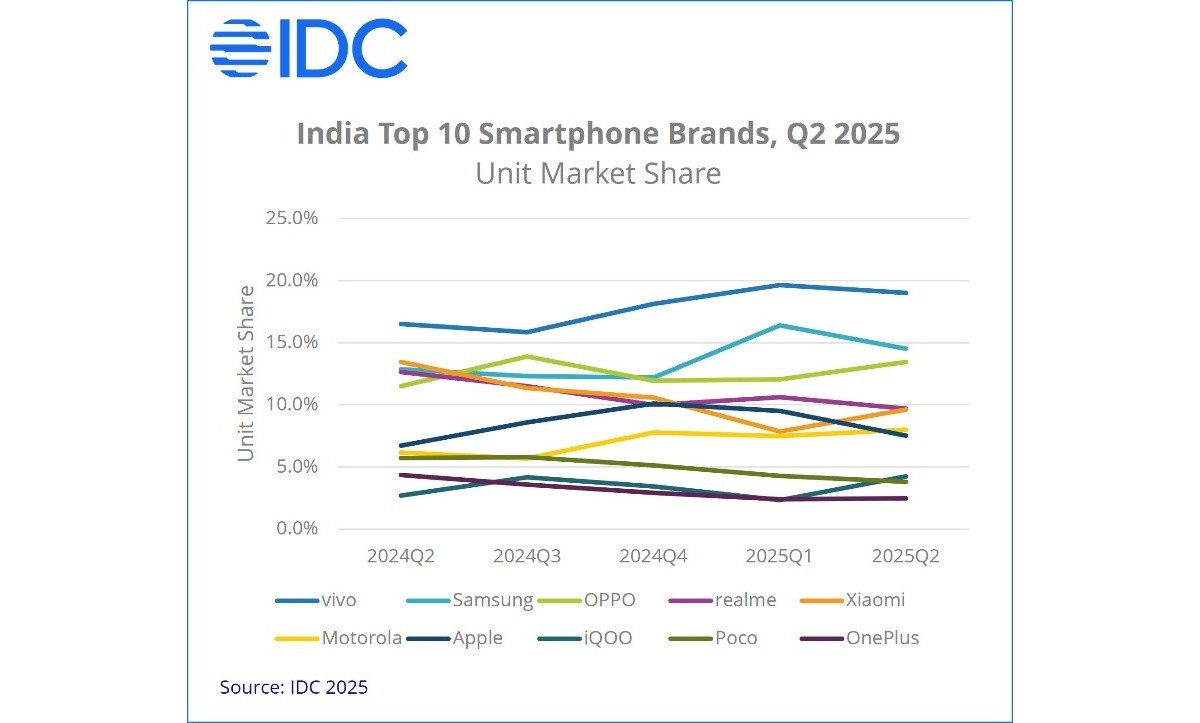

vivo maintained its position as the market leader with a 19% market share, recording a 23.5% rise in sales from Q2 2024. Samsung followed closely behind with a 14.5% market share, marking a 21% YoY growth. Other notable performers include Oppo in third place with a 12.4% share (25.4% growth), Motorola in sixth place with an 8% share (39.4% growth), and Apple in seventh place with a 7.5% share (19.7% growth). iQOO, in eighth place, also showed strong growth with a 68.4% increase in shipments.

Conversely, some brands experienced declines in shipments. Realme, in fourth place, saw a 17.8% decrease in shipments, Xiaomi in fifth place recorded a 23.5% decline, Poco in ninth place experienced a 28.8% drop, and OnePlus in tenth place had a 39.4% decrease in shipments.

The average selling price for smartphones reached a new high of $275 in Q2, marking a 10.8% YoY growth. The market segment breakdown showed growth in the under-$100 category by 22.9%, led by Xiaomi, while the $100-$200 segment saw growth with vivo, Oppo, and Realme as key players. The $200 to $400 segment experienced a slight decline, while the $400 to $600 segment showed a 39.5% increase and the $600 to $800 segment saw the highest growth at 96.4%. The over $800 segment also experienced growth at 15.8%. Qualcomm-powered devices held 33.9% of the market share, with MediaTek devices at 44.3%.

IDC predicts a slight decline in smartphone shipments for the entire year in India.