Latin America saw a 4% decline in smartphone shipments in Q1 2025, marking the end of a six-quarter growth streak. With 33.7 million shipments compared to last year's 34.9 million, the region faced challenges amidst increased competition and economic uncertainties.

Brazil, the region's largest market, experienced a modest 3% growth, while Mexico, the second-largest market with 22% of shipments, encountered an 18% decline. Central American countries, Colombia, and Peru also saw decreases in smartphone sales during this period.

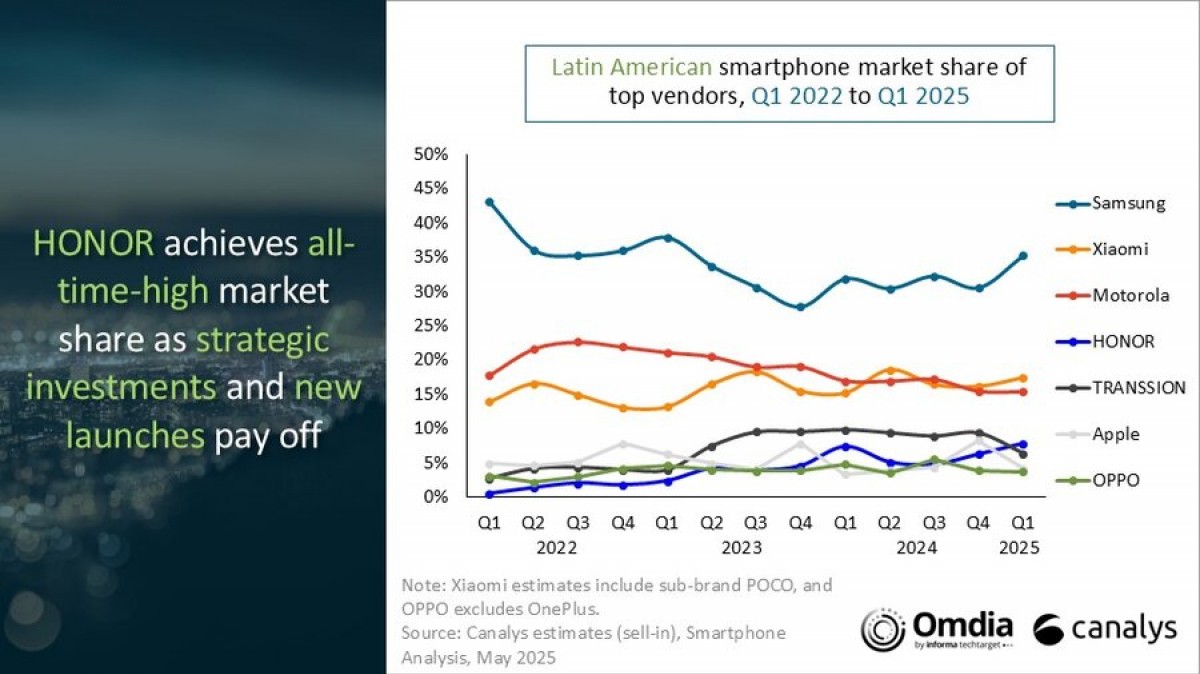

Leading the market, Samsung and Xiaomi showed growth with their affordable models, while Motorola fell to third place. Honor rose to fourth place, but Transsion experienced a significant decline in sales. Analysts attribute the shifts to competition and inventory restructuring.

Looking forward, forecasts suggest a 1% contraction in the LATAM market for 2025 due to economic uncertainties and tariff fears. Vendors are adapting by scaling back sales strategies and maintaining low inventories. Geopolitical tensions could further impact the region's smartphone market.