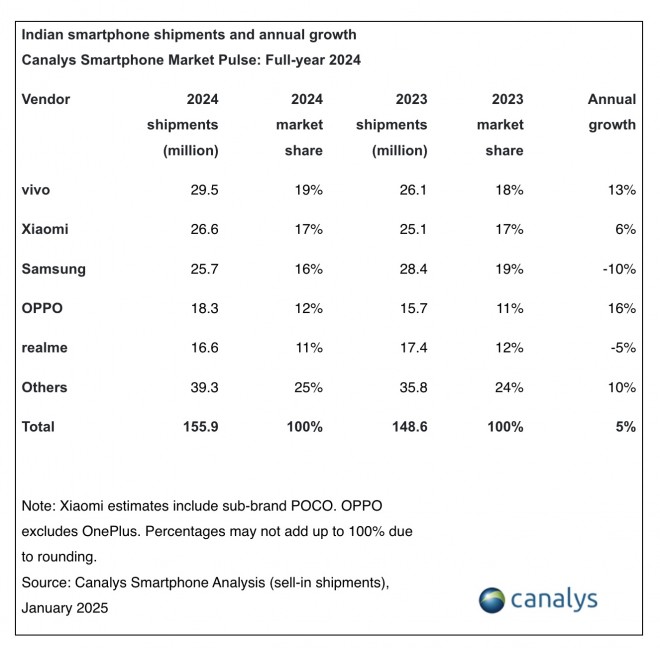

The Indian smartphone market achieved a growth rate of 5% in 2024, resulting in a total of 155.9 million units shipped throughout the year. According to a recent report by Canalys, Vivo emerged as the top smartphone brand in India, recording 29.5 million shipments and capturing a 19% share of the market. Following Vivo, Xiaomi (including Poco) occupied the second position with approximately 26.6 million shipments and a 17% market share, while Samsung secured third place with 25.7 million units shipped, representing a 16% market share.

Smartphone Shipments in India (Full Year 2024)

Smartphone Shipments in India (Full Year 2024)

Oppo (including OnePlus) recorded 18.3 million shipments, garnering a 12% market share, and Realme rounded out the top five brands with 16.6 million shipments and an 11% market share. Canalys analysts suggest that the increase in device upgrades was largely influenced by a post-pandemic refresh cycle and the rollout of 5G technology. Following a stock buildup during the festive season, brands subsequently offered heavy discounts towards the year's end.

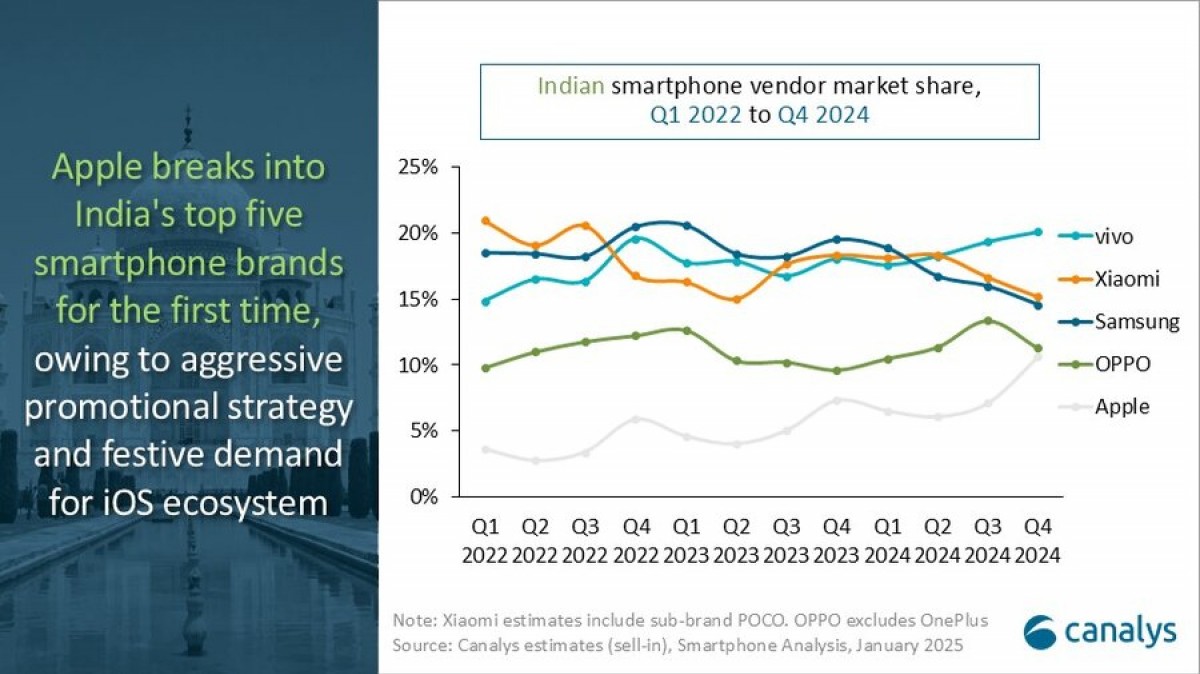

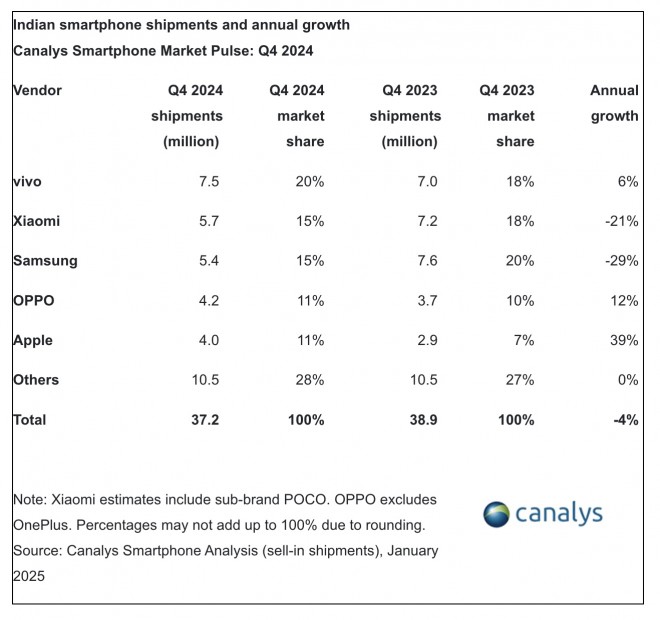

The report also analyzed shipment trends for Q4 2024, which experienced a slight 4% decline compared to the previous year. The rankings of the top four smartphone brands remained consistent year-over-year, although Apple made a notable entry into the fifth spot.

In Q4, Apple reported 4 million shipments and secured an 11% market share, tying with Oppo. Apple saw an impressive annual growth rate of 39%, primarily fueled by promotional offers during the festive season and new iPhone releases.

Smartphone Shipments in India (Q4 2024)

Smartphone Shipments in India (Q4 2024)

Looking forward, Canalys predicts single-digit growth for the Indian smartphone market in 2025, with a clear demand for devices priced between $100-$200. Conversely, interest in smartphones priced below $100 and in the premium segments appears to be dwindling.