The global smartphone market, having faced two years of decline, is witnessing a notable rebound in 2024. This year, smartphone original equipment manufacturers (OEMs) have reported a 4% year-over-year growth, signaling a much-anticipated recovery after 2023—the lowest demand year in the last decade.

Counterpoint analysts attribute this growth to the easing of economic pressures globally and the integration of AI-driven features in smartphones. Nearly all regions have shown positive growth trends, with Europe, China, and Latin America experiencing particularly strong recoveries.

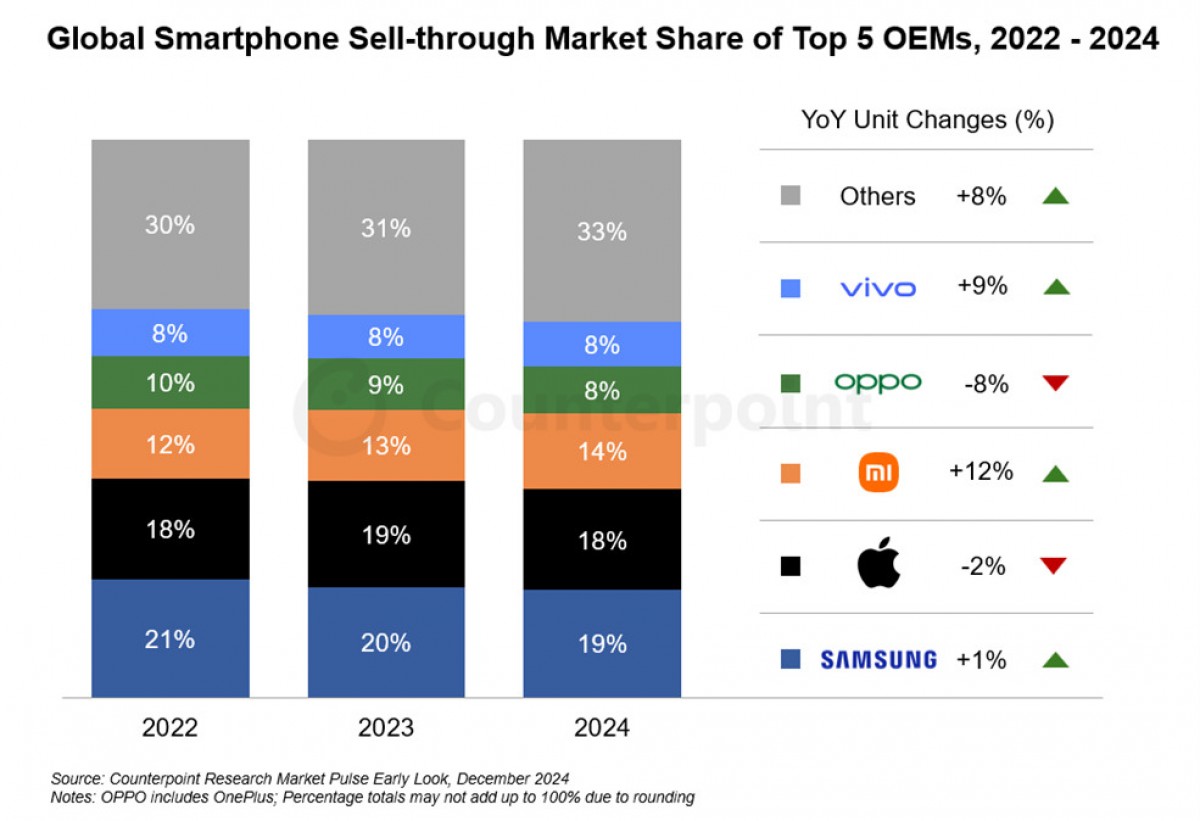

Leading the market is Samsung, which holds a 19% share, driven by robust sales of its Galaxy S24 series and select A series models. The brand enjoys strong consumer preference in Western Europe and the United States.

Meanwhile, Apple remains in second place but has seen a slight 2% dip in overall sales for 2024. This decline is attributed to underwhelming sales of the iPhone 16 series. However, the premium models—the iPhone 16 Pro and 16 Pro Max—continue to attract demand, enabling Apple to boost its revenue despite the overall sales drop.

In line with this trend, there is an increasing shift among consumers toward premium offerings, resulting in rising average selling prices that benefit manufacturers financially. Notably, the segment priced above $1,000 showed the most significant growth last year.

Xiaomi has also made a splash with a 12% increase in sales, maintaining its position as the third-largest smartphone brand. Vivo enjoyed a 9% uptick in growth; conversely, Oppo experienced an 8% decline overall, though it noted a resurgence in demand towards the year's end.

While these statistics suggest an optimistic outlook for the smartphone market, analysts remain cautious regarding a full recovery in 2025, indicating that pre-pandemic sales levels may still be some time away.