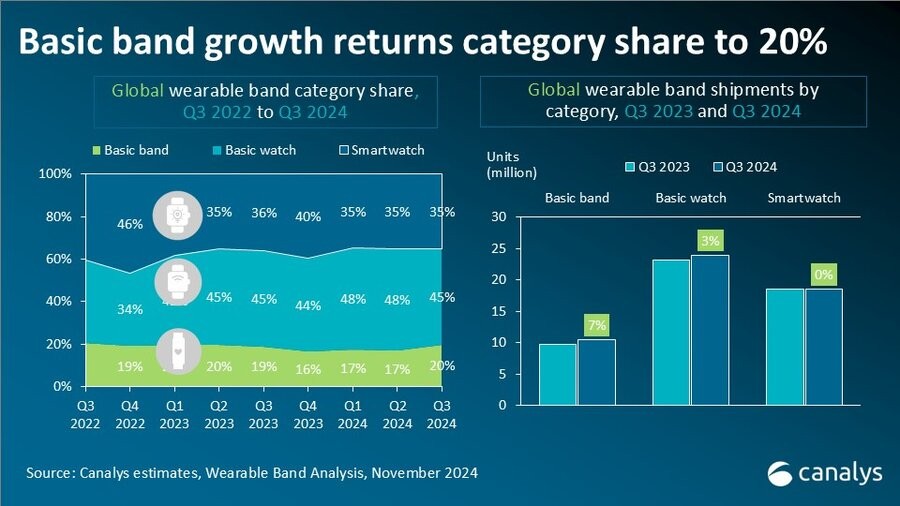

The market for wrist-worn smart devices, including smart bands, entry-level smartwatches, and high-end smartwatches, saw a moderate growth of 3% in Q3 2024 in comparison to Q3 2023, with a total of 52.9 million units shipped. This growth, however, reflects a mixture of trends across different product categories.

Leading the charge, smart bands demonstrated significant momentum with a 7% increase, reaching a total of 10.4 million units shipped. This rebound marks the first quarterly growth for smart bands since Q3 2020, after a period of decline.

According to analysts at Canalys, the surge in demand stems primarily from emerging markets where first-time buyers are enticed by the enhanced capabilities of budget-friendly smart bands. Noteworthy models boosting sales in Latin America and EMEA include the Xiaomi Smart Band 9 and Samsung Galaxy Fit3.

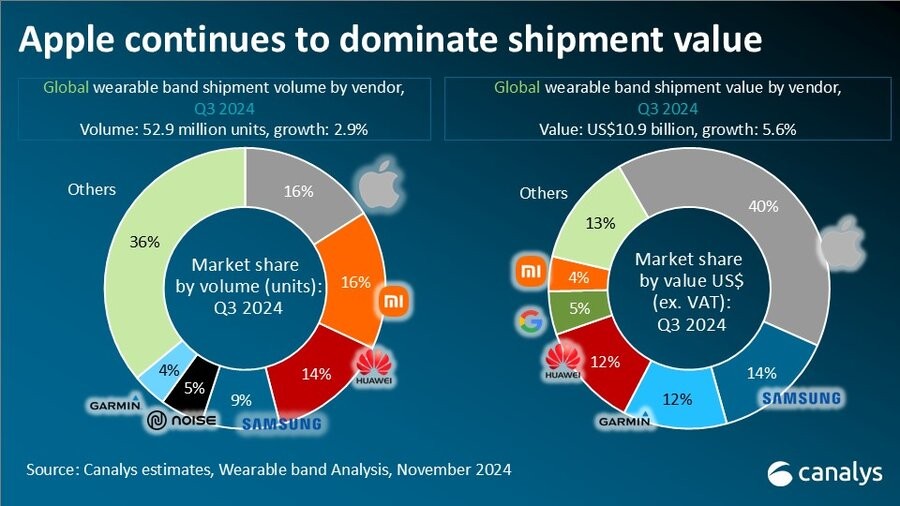

Xiaomi is particularly noteworthy, matching Apple in unit shipments at 8.5 million, capturing 16.1% of the market share. In addition to its smart band line, the Redmi Watch 5 series has also seen success, while the Xiaomi Watch S series has experienced a remarkable 70% year-on-year increase in shipments.

| Wearable Bands Global Shipments and Annual Growth in Q3 2024 | |||||

|---|---|---|---|---|---|

| Vendor | Q3 2024 shipments (million) | Q3 2024 market share | Q3 2023 shipments (million) | Q3 2023 market share | Annual growth |

| Apple | 8.5 | 16.10% | 8.9 | 17.20% | -3.60% |

| Xiaomi | 8.5 | 16.10% | 6.2 | 12.10% | 37.30% |

| Huawei | 7.1 | 13.50% | 5.1 | 10.10% | 38.50% |

| Samsung | 4.8 | 9.10% | 3.9 | 7.60% | 24.30% |

| Noise | 2.5 | 4.70% | 3.5 | 6.90% | -29.60% |

| Others | 21.4 | 40.40% | 23.7 | 46.20% | -10.00% |

| Total | 52.9 | 100.00% | 51.4 | 100.00% | 2.90% |

Despite the similarity in shipping numbers, Apple and Xiaomi yield different revenue figures. Apple accounted for nearly 40% of the total shipment value, generating $10.9 billion—a 5.6% increase compared to the previous year—while Xiaomi captured only 4% of the total. This disparity is largely influenced by Xiaomi's shift towards more affordable products, resulting in a 9% decrease in Average Sales Price (ASP), marking its lowest level since Q1 2021.

However, established markets, particularly North America, pose challenges as even Apple experiences a decline in demand for older models, with Fitbit's market share further declining. Users of higher-end smartwatches perceive fewer upgrades as manufacturers have failed to introduce compelling new features.

Jack Leathem, Canalys Research Analyst, states: “Smartwatches, which represent only 35% of shipments but 74% of market value in Q3 2024, are essential for vendors aiming for premium pricing and customer loyalty. To stay competitive, brands must keep investing in innovative hardware and software that promotes industry leadership, such as machine learning capabilities, dual-processor designs, and advanced sleep monitoring.”